Australia’s Ecommerce in 2018: How Amazon Challenges the Retail Industry

Ecommerce in Australia is growing rapidly. Last year, Australians spent a total of $1.95 billion per month on online shopping alone.

Currently, the online market size in Australia is 7.3% compared to regular brick and mortar businesses, which make up the majority of the retail sector.

According to the latest data, the annual growth rate of the online retail market is 6.0%.

Interested in the latest updates on the Australian Ecommerce market? Explore our newest article: 16 Key Ecommerce Statistics and Insights in Australia 2023

This explains why international players like Amazon and Alibaba have been eager to enter the Australian ecommerce industry. There is a lot of room for growth here. The market is ready to boom.

Let’s take the grocery shopping as an example. Online grocery sales are expanding 7 times faster than other market segments. Yet they account for just 2% of total grocery sales, reports Neilsen. This indicates that there is growth on the horizon.

It is predicted that over the next five years we will see an incremental growth of $2 billion in the online grocery industry alone. Similar opportunities for growth exist in other areas of the ecommerce landscape.

Online retail trends in Australia

Australian online shoppers mostly spend on homeware, media and groceries. Last year, multichannel retailers sold about 25% of their products online. This is expected to rise to 31% in 2018.

The following table shows how the total online spending is distributed among different categories of products.

TABLE 1

Spending habits of Australian online shoppers (Ref: NAB Online Retail Sales Index)

| Category | Percentage of total spending | Annual growth |

|---|---|---|

| Homeware | 20.0% | -5.8 |

| Media | 17.5% | 19.5 |

| Groceries | 16.7% | 6.4 |

| Fashion | 15.3% | 1.6 |

| Personal | 9.4% | 1.5 |

| Department | 8.2% | 10.2 |

| Food | 6.9% | 9.8 |

| Toys | 3.6% | 23.0 |

| Daily Deals | 2.4% | 9.9 |

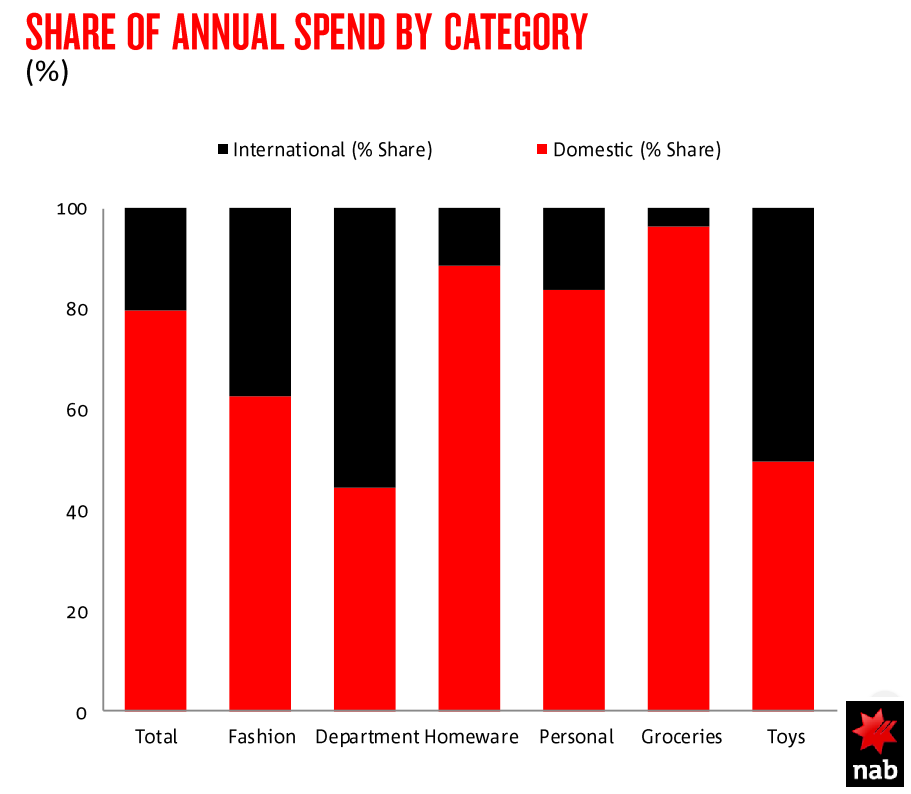

As you can see, the fastest growing segments of the online market are the toy, media and department industries. Though Australians mostly prefer domestic retailers, international marketplaces are also gaining popularity. This is illustrated in the following diagram –

The next table shows the domestic vs international competition more clearly –

TABLE 2

Domestic vs International growth for online retail segments in Australia’s Ecommerce

| Category | Annual Sales Growth International Retailers | Annual Sales Growth Domestic Retailers |

|---|---|---|

| Department | 20.4 | -2.2 |

| Media | 11.4 | 34.3 |

| Groceries | 10.7 | 6.3 |

| Fashion | 4.0 | 0.1 |

| Homeware | -7.7 | -5.5 |

| Personal | -35.0 | 11.2 |

A point of concern for Aussie ecommerce businesses is that the younger generation is still spending more on international online retailers. People in the age group between 18 and 34 accounts for 40.4% of the total international yearly spend. But the same group shares only 33.1% of the domestic spend. This trend is likely to continue in 2018.

Here are the top 5 ecommerce sites in Australia, ranked by visits:

With the exception of OzBargain, these websites belong to international retailers. Amazon Australia made it to the top 5 soon after the launch of its fully-fledged Australian website in December. It immediately overtook a number of popular Australian made and owned retail sites like JB Hi-Fi.

Arrival of Amazon

Amazon, the American retail behemoth, is the largest online retail business in the world. Its last reported annual revenue was USD 135.99 billion, which is twice the combined revenue of its nearest competitors – JD.com, Alibaba and eBay.

Amazon had a rather limited Australian site before its recent launch (previously it only had the Kindle store and Amazon Web Services). But Australians have been buying form its US site for many years. According to a recent Neilsen report, Amazon US converts about 49% of its Aussie visitors. The only Australian ecommerce brand that has a higher (53%) conversion rate is The Iconic.

In October of 2017, a total of 4.6 million adult Australians visited the Amazon US site. The table below shows how Amazon compared with other mass merchandiser Australian sites at that time.

TABLE 3

Top 5 mass merchandiser sites by unique audience in Australia

| Site | Unique Audience |

|---|---|

| Woolworths | 6.7M |

| Amazon US | 4.6M |

| Coles | 3.7M |

| Kmart | 3.3M |

| Kogan | 2.8M |

Obviously, Amazon was already popular in Australia before its country-specific launch.

But the new amazon.com.au is going to bring a lot more to the table for Australian consumers.

- Lower price:

Amazon will offer many products at a lower price than other retail stores and ecommerce sites. There will also be a number of special offers and packages for customers. - Shipping benefits:

Amazon’s free shipping with quick delivery is going to be an attractive feature for anyone. Though Amazon Prime is not here yet, delivering local products within one or two days shouldn’t be that difficult for Amazon. - Marketplace for local business:

Australian business owners can sell their products on Amazon. This gives small local businesses an opportunity to reach a larger audience. - A wide range of products:

Amazon definitely has a wide array of products. Apart from their own branded items, they will sell products from local and international manufacturers.

There is no doubt customers eagerly anticipated the arrival of Amazon. Neilsen’s survey found that 75% of adult Australian’s were interested in Amazon’s venture in the country. Most of the people surveyed showed interest in buying Electronic items (60%), Books (54%) and Clothes (46%) from Amazon.

The following graph shows a summary of the survey-

Amazon finally launched its retail and marketplace service for Australian customers on December 5 of last year. The global record-breaking launch was dubbed as a soft-launch by the experts. Amazon’s main strategy is to rapidly roll out its complete range of products and services (like Amazon Prime and AmazonFresh) over 2018 without going for a massive launch at once.

The potential impact of Amazon on retailers

According to the analysis of Brain And Company, Amazon will become the sixth-largest retailer in Australia in 5-10 years. It might not suppress Australian retail giants like Woolworths and Coles, but it will most likely outpace retailers like Kmart, JB Hi-Fi and Harvey Norman.

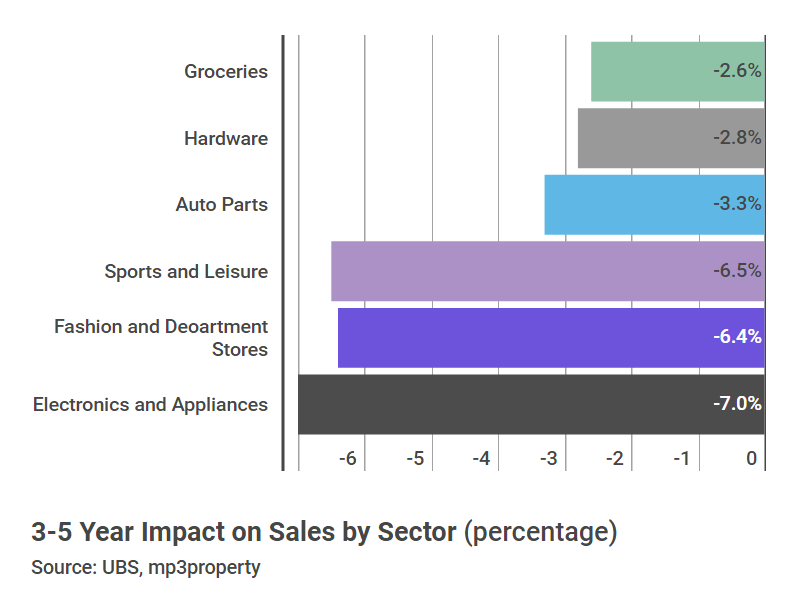

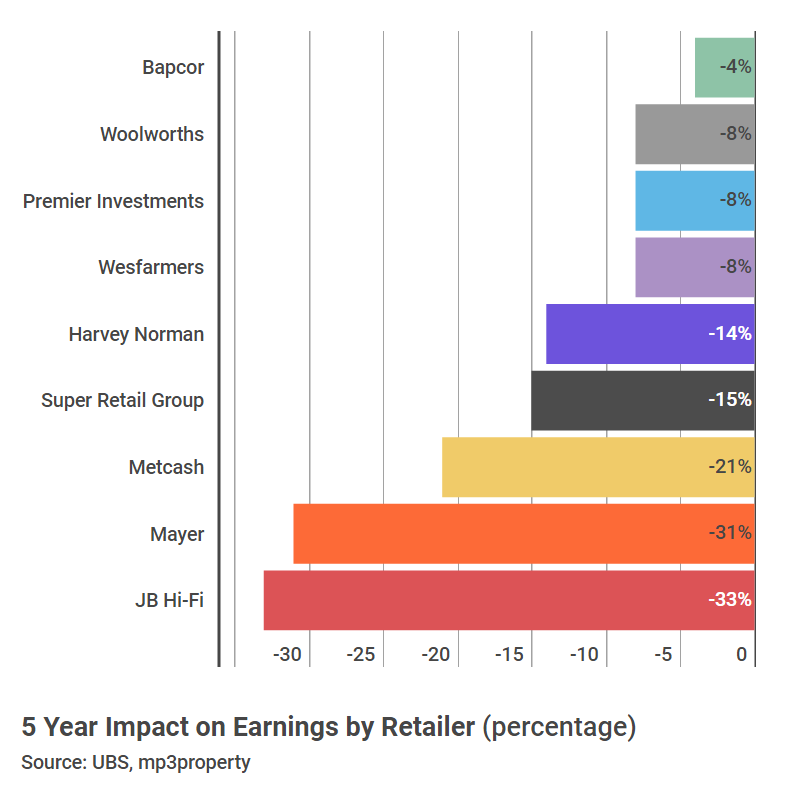

Another study by UBS shows how Amazon will impact the earning of major Australian retailers in the next 5 years –

JB Hi-Fi is likely to be the most affected. This isn’t surprising as Amazon will directly challenge JB’s electronics and appliances focused business.

But retailers in other sectors such as Fashion, Department and Leisure will also feel the pressure. Amazon will cause a 6.4% decrease in sales of Fashion and Departmental products of Australian businesses in the next 3-5 years.

Citigroup’s report predicts Amazon will capture 14% of the total online spending in Australia within the next 5 years. And the price competition will reduce the Australian consumer price index (CPI) by 0.25% (UBS data).

Another research organization, Morgan Stanly forecasts that by the next decade Amazon will take at least $12 billion away from Australia’s ecommerce market.

These are not very good news for Australian retailers. But how are they trying to cope up?

Can Australia’s ecommerce businesses compete with Amazon?

The Commonwealth Bank conducted a survey regarding how the Australian retailers are planning to deal with Amazon’s expansion into Australia.

The result of that survey is as follows –

- 41% retailers see Amazon as a threat

- 11% retailers see Amazon as an opportunity

- Only 5% retailers have a strategy to cope up with Amazon

- 33% businesses are planning to outcompete Amazon by providing a better customer experience

- 30% are planning to offer better products

The survey concluded that big retail and ecommerce businesses are not all that well prepared to deal with Amazon’s massive size and capability. As Amazon increases its ecommerce market share in Australia, these businesses will certainly feel the heat.

On the other hand, Amazon might bring new opportunities for small businesses and independent brands. Its Marketplace will let them sell directly from Amazon’s website, enabling them to reach more customers online. Thus, small local retailers can leverage Amazon’s platform to grow their business.

Ultimately, whether or not Amazon will disrupt the ecommerce ecosystem of Australia remains an open question. But there is no doubt Aussie retailers will face fiercer price competition, starting from this year.

Is it possible to compete against a dominant force like Amazon in the online space? There are several global examples that suggest that it is very possible. Despite operating in Canada for many years, Amazon hasn’t radically changed things or affected the country’s local retailers to any great extent. And in India, Amazon failed to curb the growth of India’s homegrown retail giant Flipkart.

Then again, being the largest ecommerce company in the world, Amazon has the luxury of selling products at a marginal profit or even at loss for a duration long enough to outrun the local competition. Online retailers and ecommerce website owners must improve their delivery service, customer relations and focus on innovative business ideas to compete with Amazon in the coming years. A price war is not going to be a successful long-term strategy for those going up against Amazon.

You read a lot. We like that

Want to take your online business to the next level? Get the tips and insights that matter.