16 Key Ecommerce Statistics and Insights in Australia 2023

With Aussies spending a record $353 billion on retail goods in 2022, which is 9.2% more than in 2021, one thing is clear: the ecommerce landscape in Australia is evolving and even getting more prominent in 2023. No wonder Australia’s ecommerce market revenue is expected to reach US$37.65bn in 2023.

With such big numbers, it becomes evident that there’s no better time for ecommerce to thrive in Australia. However, to truly excel in this dynamic landscape, it’s crucial to understand the context comprehensively.

Here, we have brought together the most current Australian ecommerce statistics for 2023 to ensure you stay informed about emerging trends and consumer behaviour driven by data.

The current position of Australia in the ecommerce market

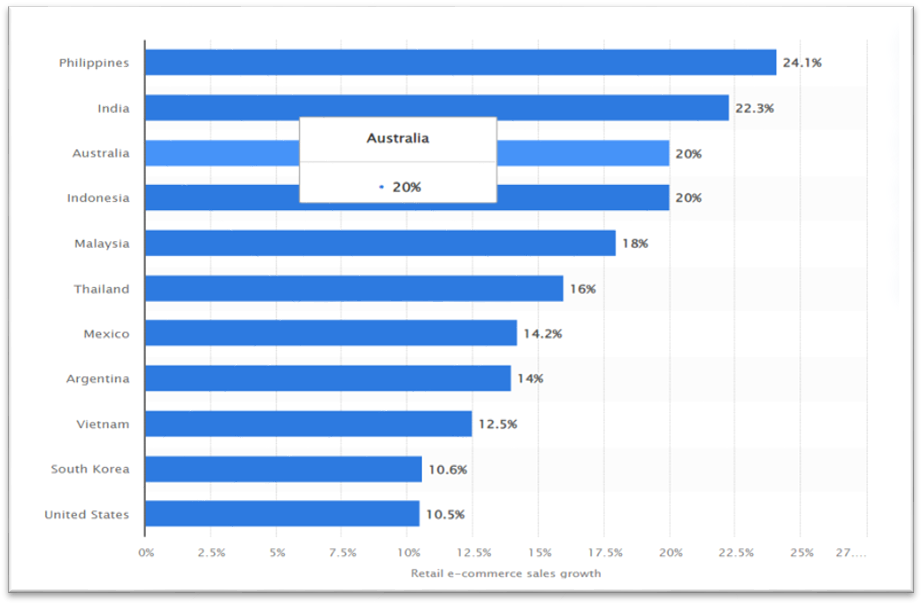

1. Australia is one of the fastest-growing retail ecommerce countries, with a sales growth rate of 20%

Driven in part by a surge in internet usage worldwide in recent years, the global ecommerce retail sector experienced remarkable growth, whereas global retail ecommerce sales are forecast to reach about 8.1 trillion dollars by 2026. Among the leading countries based on retail ecommerce sales growth in 2023, Australia is one of the key players, with a sales growth rate of 20%.

Here are the top 11 countries based on retail ecommerce sales growth.

- Philippines

- India

- Australia

- Indonesia

- Malaysia

- Thailand

- Mexico

- Argentina

- Vietnam

- South Korea

- United States

Source: Statista

2. Australia is the 14th largest market for ecommerce, reaching the predicted market volume of US$53,339.9 million by 2027

Australia ranks as the 14th largest player in the ecommerce market, poised to generate an impressive $36,825.2 million in revenue by 2023. In 2023, Australian ecommerce will grow by 6.3%, contributing to the global 9.6% increase and the revenue is expected to come with a projected compound annual growth rate (CAGR 2023-2027) of 9.7%, propelling the market volume to an estimated $53,339.9 million by 2027.

Source: ecommerceDB

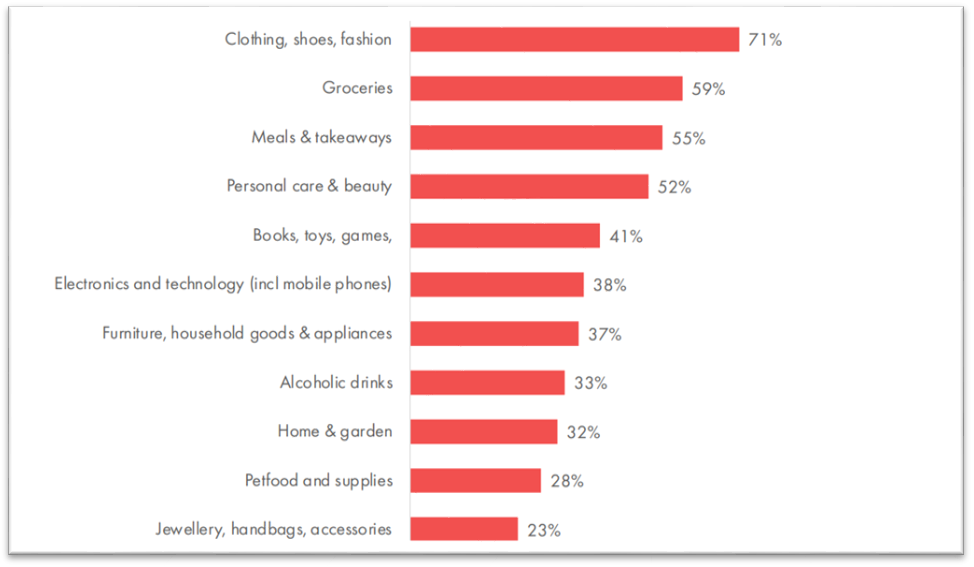

3. Clothing, shoes and fashion remain the most popular online purchase

When fashion and beauty rank among the most popular online retail categories in 2023, clothing, shoes and fashion reign as the top online purchases, with 71% of online shoppers buying these online.

Source: IAB Australia

4. On average, 5.5 million Australian households made at least one online purchase each month

With a record of 82% of Australian households making an online purchase in the last year, which represents 9.4 million households, one thing is clear: Australians love online shopping. In 2023, the average purchase rate is up 3.9% from last year. So, the purchase frequency has improved. Especially during sale events, more households are buying online.

Source: Australia Post

Online shopping behaviour statistics

5. 6 in 10 are shopping online every 2-3 weeks, maintaining the frequency of shopping over the last year

Online shoppers have maintained their frequency of shopping online over the last year. Approximately 6 out of 10 individuals, equivalent to 59% of respondents, consistently engage in online shopping every 2 to 3 weeks, demonstrating a sustained frequency of online shopping habits over the past year.

Source: IAB Australia

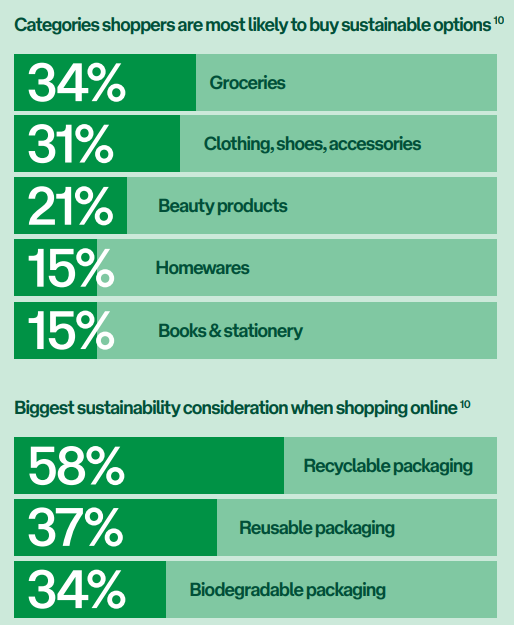

6. 3 in 4 shoppers are opting for sustainable options when shopping

In an era marked by the detrimental environmental impacts of fast fashion and the rise of technologies such as NFTs, sustainability is increasingly a crucial staple to shoppers. Many Australian consumers are awakening to the paramount importance of sustainability in their purchasing decisions.

Hence, a prominent shift towards sustainability has emerged as the biggest change to the retail landscape as people want marketers, retailers, and brands to be more transparent about their products’ sources and sustainability.

Source: Australia Post

7. Today’s online shoppers desire savings alongside convenience

In 2023, even if convenience holds its position as the top motivator for online purchases, a decline has been seen compared to the previous years, while discounts and price comparisons are becoming the key drivers for online shopping this year. Alongside lower prices, click and collect, fast shipping also significantly increases as reasons for buying online.

Convenience and cost savings are the two top essentials that online shoppers want when it comes to online shopping. 59% of consumers actively seek out online discounts or promotional codes directly from the retailers themselves, 32% favour physical coupons from coupon books or receipts, and 23% opt for cash rewards to save.

Source: IAB Australia

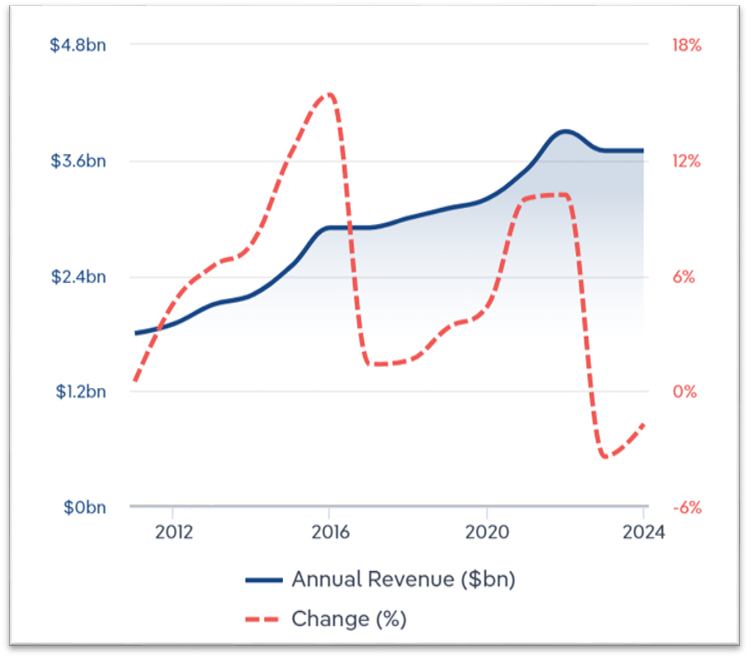

8. The pet products category saw a massive growth of 3.7 billion by 2023-2024

Australia has one of the world’s highest rates of pet ownership, with over two-thirds of Australian households owning a pet. With the rising trend of pets being treated as family members, households are allocating a greater portion of their budgets towards providing the best for their furry companions, which results in increased expenditures on premium pet foods, specialised dietary supplements and vitamins, fashionable pet accessories, delectable treats, etc.

So, industry revenue is expected to increase at an annualised 3.8% over the five years through 2023-24 to $3.7 billion.

Source: IBIS World

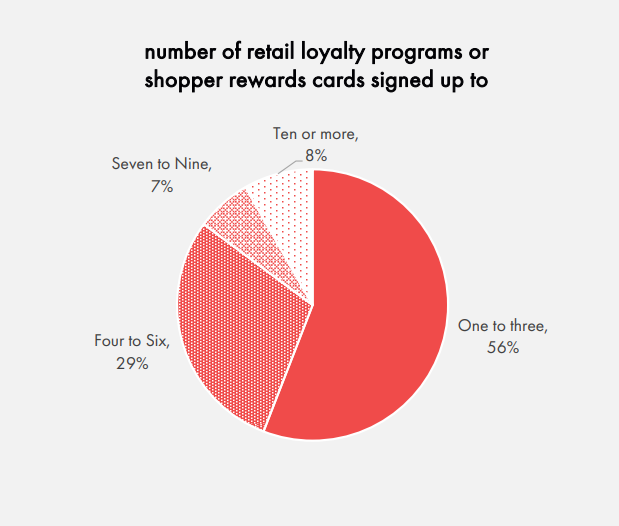

9. 9 in 10 online shoppers remain signed up to at least 1 shopper rewards program

While nine out of ten online shoppers are enrolled in at least one rewards program, 44% of them have four or more cards. Loyalty programs are becoming increasingly important, with 62% of online shoppers increasing their usage as they look to enhance their shopping experience while saving money.

Source: IAB Australia

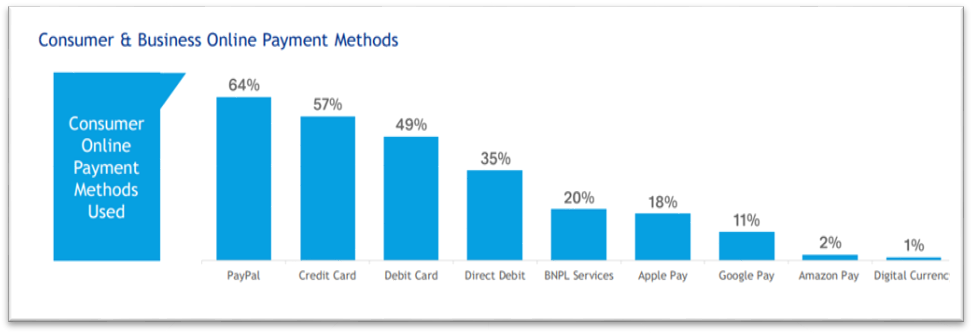

10. Almost two-thirds of Australians (64%) use PayPal for online payments

PayPal is the most used online payment method in Australia. The data shows that PayPal is the top choice for online shoppers of all ages in Australia. It shares the lead with credit cards among Gen X shoppers. This preference surpasses the popularity of more conventional financial products like credit cards (26%), debit cards (14%) and other options, such as Apple Pay, BNPL, and direct debit.

Source: PayPal ecommerce index

11. 26.4% of all Ecommerce transactions occur via mobile phone

Mobile commerce is a significant growth frontier in Australian ecommerce, with mobile transactions accounting for 26.4% of all ecommerce transactions, marking a 28.8% year-on-year increase. And if we notice the frequency of mobile shopping among customers, most customers who make online purchases through their smartphones tend to do so on a monthly basis.

Source: Mordor Intelligence

12. 29% of customers anticipate quicker delivery times

As shoppers accept deliveries to come faster, omnichannel retail has become the point of innovation that empowers both brick-and-mortar and online businesses to fortify their resilience within an ever-changing shopping landscape. Many ecommerce companies are doing omnichannel fulfilment work to deal with customer needs.

Source: Australia Post

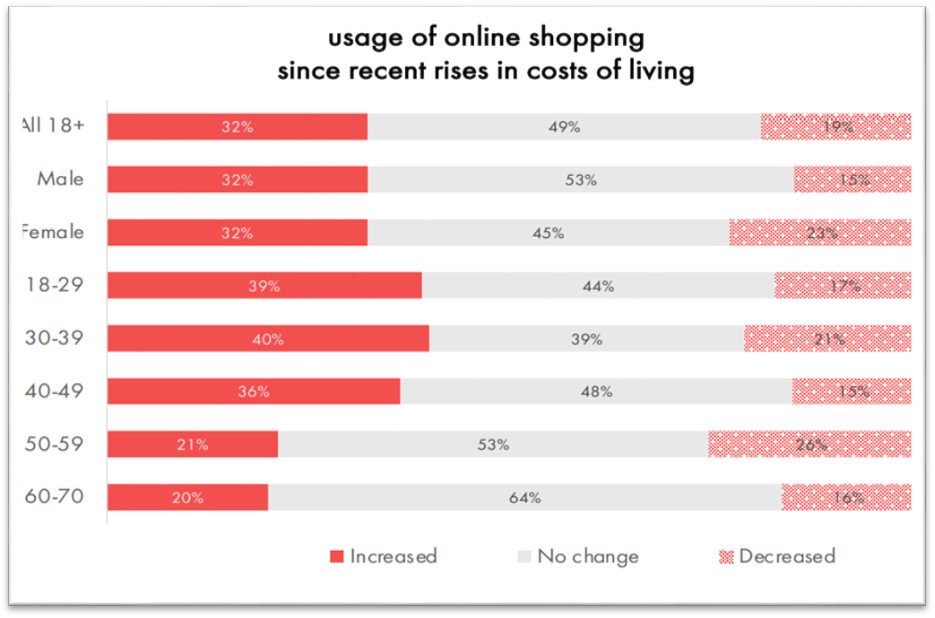

13. 4 in 10 online shoppers aged 18-39 have increased their usage of online shopping

Due to the recent upsurge in the cost of living, 4 in 10 online shoppers between the ages of 18 and 39 have increased their usage of online shopping. Overall, 32% of individuals have escalated their engagement in online shopping, while 19% have decreased their usage.

Source: IAB Australia

What the future of ecommerce holds in Australia?

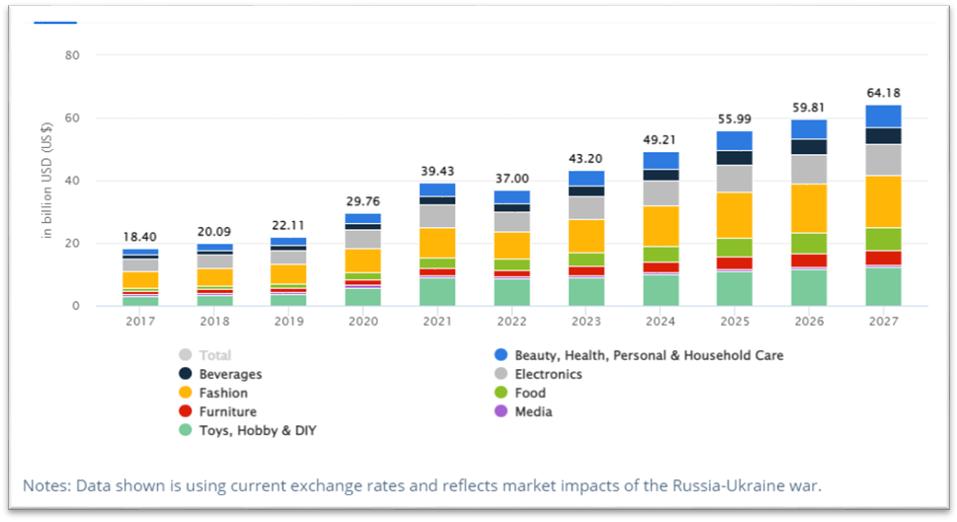

14. Australian ecommerce is set to soar with a 10.41% CAGR over the next four years, reaching $64.18 billion in sales by 2027

Ecommerce in Australia witnessed a remarkable surge in 2022, and its momentum shows no signs of slowing down. Projections indicate that this thriving sector will achieve a substantial milestone, with $43.21 billion in sales in 2023.

Also, it is expected to flourish at an impressive compound annual growth rate (CAGR) of 10.41% over the coming years, ultimately reaching an astonishing sales figure of $64.18 billion by the year 2027.

Source: Statista

15. Australian customers are shopping through social media, with an expected surge to 6.4 million by 2024

In 2022, the majority of customers planned to make at least one purchase through social shopping, and the trend didn’t show down. Forecasts show the count of consumers in Australia who use social media for online shopping will increase to 6.4 million by 2024 as they plan to use shopping features within a platform (Instagram Shops, Facebook Shops, TikTok Shopping, etc.).

Suppose businesses can leverage Instagram Shop for a distinctive shopping experience, complete with product tutorials and easy in-app checkout. Customers can also reach out via direct messages for any queries.

Source: Statista

16. User penetration will be 76.0% in 2023 and is expected to hit 77.6% by 2027

In 2023, experts estimate that the user penetration rate will stabilise at an impressive 76.0%. Peering further into the future, indications point towards a continuous increase, with projections aiming for it to land at approximately 77.6% by 2027. This consistent rise in user penetration reveals a favourable and enduring growth outlook.

Source: Statista

Leading online retailers and marketplaces in Australia

As the ecommerce industry continues to grow and consumers seek convenient and diverse shopping options, marketplaces remain a vital part of Australia’s retail landscape. A survey by Statista revealed that American-based marketplaces eBay and Amazon are the top choices for Australian online shoppers, with 60 per cent and 52 per cent of respondents, respectively.

Local platforms like Kmart, Coles, and JB Hi-Fi have also gained traction. So, if we list the most visited marketplace websites in Australia, it will include

- Amazon

- eBay

- Kmart

- Big W

- Woolworth

- Coles

- Chemist Warehouse

- JB HiFi

- Target

- Myer

With the rising shift of businesses towards ecommerce while distancing themselves from traditional brick-and-mortar establishments, there will certainly be more competition. However, by implementing the right strategy and use of data in the right place, you can set your ecommerce business to thrive.

So, no matter whether you’re already running an ecommerce store or planning to start one in Australia, the mentioned statistics and information are definitely a key reading for you.

References:

- 2023 Inside Australian Online Shopping | Auspost

- eCommerce – Australia | Statista

- Inside Australian Online Shopping Quarterly eCommerce update July 2023 | Auspost

- Australian Ecommerce Report 2023 | IAB.Australia

- eCommerce market in Australia | ecommerceDB

- Industry Market Research, Report and Statistics | IBIS World

- PayPal ecommerce index- 2022 Annual Report

- Australia Ecommerce Market Size & Share Analysis – Growth Trends & Forecasts (2023 – 2028) | Mordor Intelligence

- Top Marketplace Websites Ranking in Australia | Similarweb

- Australia’s Online Shopping Behaviour Report – 2022 | Savvy

You read a lot. We like that

Want to take your online business to the next level? Get the tips and insights that matter.