A Beginner’s Guide to Market Research

The year was 1994.

Fiat, the Italian automobile giant, decided to send fifty thousand anonymous love letters to young Spanish women. This was part of a promotional campaign to acquire a portion of the Spanish car market. This idea was based on market research that showed a high affinity for passionate conversation among Spanish people.

The plan was to get these women so curious that they would be looking forward to the test drive that Fiat would propose when they revealed their identity.

Since this idea is unique, unprecedented, and personalised, everyone expected it to be a mammoth success.

This novel approach, instead of sparking curiosity, caused panic and anxiety among the women who received the letters! One of them actually took the matter to court, and Fiat ended up compensating her!

So, what went wrong?

Well, the market research design of Fiat did not test this method of outreach. If it did, the cost of the entire process, along with the legal compensation, could have been avoided.

Even if your business is not a giant like Fiat, you may end up wasting your precious marketing budget if thorough market research is not performed. Since most small and medium businesses assume well-rounded market research entails huge resources, they tend to run ads based on minimal research.

In this article, we’ll try to cover the relevant bases of market research that SMBs need to be aware of to make effective marketing decisions.

Before we proceed, let’s make sure we all are on the same page regarding the scope and purpose of market research.

So, what exactly is market research?

Dr Paurav Shukla, head of digital and data-driven marketing at Southampton Business School, described market research in the following way:

Market research is the process of identifying and defining marketing opportunities and problems. It entails designing methods for collecting information on relevant aspects of the market. Furthermore, it is required to generate, refine, and evaluate actionable marketing options. Last but not least, market research improves understanding of marketing as a process and of making specific marketing activities more effective. The entire process acts as the base for making informed marketing decisions.

According to Dr Shukla, market research must accomplish the following:

- Clearly define the problem that will be addressed through research.

- Determine if the issue deserves research.

- Fix ways of gathering information for the research.

- Formulate ways of analysing the data.

- Translate the derived insights into data which is suitable for marketing and management decision-makers to use as a basis.

OK. I know what market research is. But is it always necessary?

The very first step is to generate a research question that you want to address through your market research.

So how should you generate a research question?

Scott M. Smith and Gerald S. Albaum, market research experts from Qualtrics, have answered this question beautifully in their book “Basic Marketing Research: Volume 01”.

According to them, a research question must stem from a management question or challenge.

A management question focuses on actions that the management needs to take. The research problems, on the other hand, focus on collecting, analysing and providing the information that the management body needs to address management problems.

The table below should make this crystal clear:

| Management question |

Research question |

| Why are sales not growing? | What data should we collect on potential customers, first-time buyers and repeat purchasers? How should we analyse the data to derive relevant answers and options for the management? |

| Does the advertisement budget need a hike next quarter? | What advertisement metrics should we use to determine the ROI of the ad spend? Are there any factors beyond our control like adverse weather or warfare? Is there a population influx predicted in the next quarter? Are we going to broaden our target customer base? What trends or market data are there that indicates a higher ROI with greater expenditure? |

| Should we change our logo and motto? | What data do we have from previous brand equity and customer attitude surveys? Have there been any surveys conducted that indicates a major issue regarding brand perception? Are the metrics used before still relevant? |

Once you have zeroed in on a research question that you want to pursue, you have successfully taken the first step in a very important journey.

What’s the next step?

A market researcher must determine the question that the research will answer. If the question seems unclear, then the wisest course of action is to get more information regarding the question. This includes the importance and possible impact of the question, the people who need the answer, the circumstances which gave birth to the question and so on.

The next step for the research specialist is to go through the company database to locate any studies or reports related to the research query. In some cases, data which is a few years old may still be useful.

If your company is planning to expand its marketing activities across borders or target a global audience, then internal data may not be enough. In that case, you, as a researcher, would need to gather external data relevant to the question at hand. Published reports and case studies from research publishers such as MARKET SEARCH, McKinsey, Mintel and PWC can provide effective insights regarding your question.

At this point, you are supposed to have enough information on hand about your research problem. If this information, combined with the experience and intuition of the business marketing strategists, does not answer the question, then it is time for you to design a research methodology.

How would I design a market research methodology?

When designing a market research methodology, the first phase should be qualitative research. This type of research may not always be necessary, but nonetheless, we recommend it, as it can provide direction for the next phase.

Do keep one thing in mind. Before you begin designing your research, write down the time and date by which you need the research complete.

If you need to make a major investment or marketing decision five days later, your research duration cannot exceed four days. On the other hand, if that decision-making moment is a year or six months away, you can take up to 3 or 4 months for your market research.

What is qualitative market research?

Qualitative research is a form of research which aims to derive deep insights from peoples’ behaviour to understand why they behave in a certain way. When it comes to market research, the key purpose of a qualitative study is to find peoples’ perception of a certain product, service, advertisement, or a brand in general.

According to Paul Hague, the founder-director of B2B International, qualitative research is exploratory and uses techniques that generate answers which aren’t confined to four or five options.

Who would be the participants of my qualitative research?

Before you conduct a qualitative study, you need a clear idea about who the audience of your study should be. These are the people the marketing department wants to address with an ad campaign based on your market research. It’s imperative that you have 3-4 profiles that represent this audience.

One thing you must keep in mind, the more detailed your buyer personas are, the more questions you have for your qualitative market research.

Even though businesses include a diverse range of components in their buyer persona, there are some which are considered standard:

- Demographics

- Professional goals

- Challenges faced at work

- Location

- Relationship status

- Number of kids (if relevant)

- Preferred social media platforms

- Online behaviour

Profiles with this information will help you:

- Form relevant questions that bridge the gap between the brand and the target customer.

- Determine how to conduct qualitative research effectively.

- Derive insights about the potential pain-points of intended customers of your business.

With a detailed persona, the content and marketing team can make informed decisions about the types of content that will appeal to target customers and convince them to take on our services.

That’s pretty helpful! But can you elaborate on exactly how I can conduct qualitative research on my target audience?

Qualitative studies can be broadly categorised into two groups:

- Online methods

- Real-life methods

Online methods, as you can understand, are ways of getting peoples’ opinions over the internet. In most cases, these methods won’t cost you anything. In some cases, though, you may have to provide an incentive of some kind.

Some of the best go-to online platforms for a study are:

1. Quora

Quora is a popular question-and-answer website. Since it has over a quarter-billion monthly active users, it’s highly likely that you’ll get answers to your market research questions.

2. Reddit

Reddit is a popular web content rating and discussion website. Like Quora, it also boasts over a quarter billion monthly active users. On Reddit, questions get twice the response as normal posts; that’s a huge plus for your online qualitative market research.

3. Twitter chat

If your buyer persona includes active Twitter users, then Twitter chats can be a rich source of insight into your target audience. For instance, if your business developed a product for SEO metric measurement, then your target audience are SEO professionals. In this case, you’ll get clues on pain-points for your audience from a Twitter chat like #SEMrushchat. Armed with the knowledge that you glean from here, you can host your very own Twitter chat and get answers to your questions.

4. Facebook groups

There are many groups on Facebook, where people who fit your buyer persona might hang out. These groups, just like Twitter chats, can provide you with clues as to what people feel about your product/service or those similar to yours. If you post your questions here, you can expect resourceful answers.

Real-life methods, on the other hand, are more reliable as you have the dedicated attention of your audience.

Focus group discussion (FGD) is a prominent real-life method of qualitative market research. It involves a group consisting of people who have used your product/service or something similar. This group must span your full range of buyer personas.

Suppose you have gathered data which suggests that 49% of the people who fit your buyer persona are likely to be interested in your product/service; an FGD can explain why they are interested. It is very effective when it comes to getting an opinion on a specific aspect of your company, ads, products or services.

That’s quite interesting! Can you briefly tell me how I can successfully conduct a focus group discussion for my market research?

When designing and conducting an FGD, we suggest you keep the following in mind:

- Get written consent from your FGD participants before the discussion.

- Keep the questions open-ended. Your participants should not be able to answer them with a yes or no.

- Ensure that your questions are clearly worded. If possible, conduct a mock session among family, friends or colleagues who also fit your buyer persona.

- The number of questions should be under ten.

- Select gender, age and professional hierarchy depending on your product/service. For example, if your business is in the maternal health niche, some women may not be comfortable with the discussion if men are present.

- Keep the duration of the discussion under 90 minutes. Too long a discussion will cause weariness among your participants.

- Your FGD questionnaire must consist of probe questions followed by follow-up and exit questions.

- Invite 10-20% more participants than you need, as some will be absent.

- As the moderator, anticipate the FGD to take an unexpected route. If that route seems productive, let the conversation continue on.

If you would like to read further about FGDs, have a look at the following resources:

Suppose your research question is, for our XYZ product/service, which were the key factors that influenced customer satisfaction in the past two quarters?

Remember that you have a detailed buyer profile; form questions you would ask these people to get an exploratory answer to your research questions. Sample questions could include:

- How has our product/service been helpful to you?

- Does our product help you more in professional or personal life?

- What do you visualise when you hear the name of our product/service or see our logo somewhere? How does it make you feel?

- What other ways can our product/service be of help to you?

- How does the opinion of your family and friends regarding our product/service differ from yours? Can you relate to their opinion? If made responsible, how would you address these issues?

- In public conversations, what are the comments you have come to hear about our service/product?

- When you first heard about XYZ, what were your expectations? How many of those have XYZ been able to meet?

- What future expectations do you have around XYZ?

- If asked to complain about XYZ, what would your response be?

- Have you recommended XYZ to anyone? What have you said about XYZ when you did?

After you have conducted a qualitative study, you have an idea about the feelings and thoughts of your target audience around a diverse range of aspects of your research question.

Inevitably the samples of respondents are small as there are physical limits as to how many interviews or focus groups one or two researchers can carry out. This means that the analysis is interpretative, subjective, impressionistic, and diagnostic.

—Paul Hague

These ideas show what you need to measure in your quantitative research.

You know what I am going to ask; how do I conduct a quantitative study?

If you want to attach a number to the findings of your qualitative market research findings, then a survey is what you need to conduct.

The two integral components of a survey are:

1. Forming a questionnaire

The questionnaire must have questions worded specifically for target respondents. We suggest keeping the answers from being too direct. Direct questions limit the data that you can extract from participants.

For instance, instead of asking “on a scale of 1-5, how to do you like our product/service?” ask broad questions;

“Which features of our product benefit you the most?”

“Which features have you used in the last two weeks?”

“What expectations did you have when purchasing our product/service?”

“What made you choose our service/product?”

“Would you purchase this product from our company again?

“If our product/service cost rose by $X, would you still buy it?” etc.

2. Reaching respondents of interest

For an online survey, the method of reaching your target respondents depends on where they spend time. For example, if your business or your research client is in the trendy clothing and accessories niche, then Instagram would be your ideal choice. If the niche is fuel cards, then your target audience is business people who you can find on LinkedIn and Twitter.

Understood. So how do I reach these people?

A great way to reach your target survey respondents is to run paid campaigns. Now, don’t think of paid campaigns as a punch in the gut. If you gather enough data, you’ll be in a position to make ten times as much via informed and accurate marketing decisions.

What’s next?

Next, there is the codification of data you gathered from your qualitative and quantitative market research into categories. You should divide the gathered data into categories so that you can derive meaningful insights and relationships between various factors.

For example, if your research question was, “which car care/repair products 28-44-year-old Australians working in the banking industry in Melbourne have purchased most in the last quarter?”, then the following could be sensible categories:

- Number of car-care products they have purchased

- Types of products

- Age of their cars

- Types of issues they had with their car

- Roads they frequent

- Purpose of car use (official, personal)

- The occurrence of different issues at which time of year

How do I visualise the data?

This part is pretty easy.

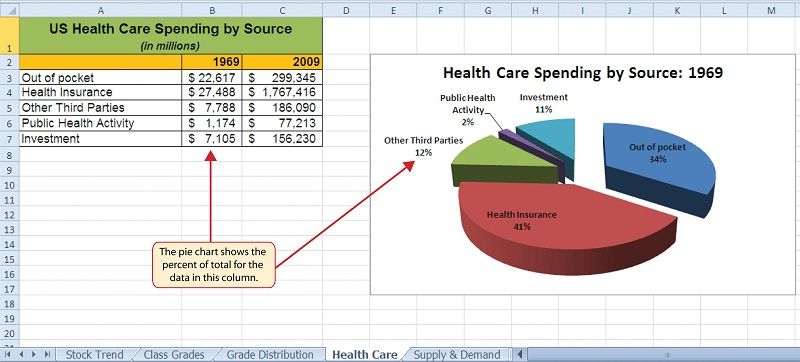

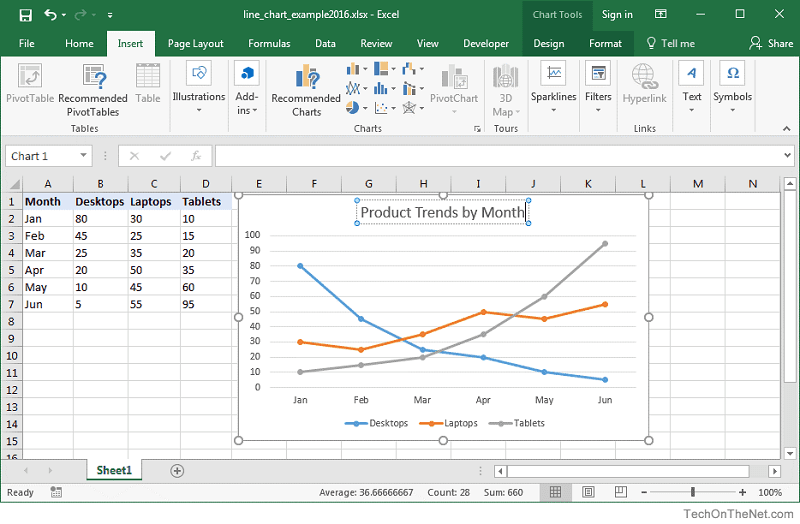

All you have to do is enter the data from your quantitative market research; for this purpose, MS Excel is tremendously useful.

As you can see below, such visualisation will be immensely helpful in deriving insights from your market research data.

(Image source)

(Image source)

But how do I extract useful information?

We suggest you follow these steps:

- Write down the variables represented in the visualisation.

- Note the most obvious relationship between the variables. Do they have an upward or downward trend? What does the maximum or minimum point mean?

- Derive the rate at which one variable is changing with respect to the other. (not relevant for pie charts)

- Try to find an underlying reason behind behaviours. If necessary, talk to an expert.

- List all factors relevant to the behaviour represented in the visualisation.

For pie charts, you need to follow the steps below:

Determine the demographic details of the people corresponding to the biggest segment in the pie chart.

Analyse the response of these people to your research questions. Try to find why they responded the way they did. Your qualitative market research findings help with this step.

Reduce the underlying factors to a set of information that the marketing people can rely on to design marketing campaigns that convert.

I have gathered quite a bit of information so far. But how can I translate this into marketing options?

Let’s say your data suggests that product/service XYZ is more popular among 18-25-year-old Australian women during summer than compared to the rest of the year.

Before you use this piece of information in your marketing campaign or include it in your market research report, it is paramount that you test this hypothesis.

How do you do that? Well, have a look at previous secondary data going as far back as five years (this depends on your time allocation for research). If you see a similar pattern, then it is safe to use this information for marketing purposes.

At this point, you should be ready for a scenario where previous data turns out to be inconclusive.

In this case, it is mandatory to conduct another round of qualitative and quantitative studies.

Do I have to prepare a report?

Of course! A report is a great resource to summarise your market research findings in an organised and usable manner.

Whether you are going to make the marketing decisions yourself or you are required to assist the marketing department, a report also acts as a reference for future marketing purposes.

How do I prepare a report?

Scott M. Smith and Gerald S. Albaum have offered valuable guidelines for preparing a market research report in their book “An Introduction to marketing research”.

From those guidelines, the ones most relevant to small and medium businesses are listed below:

- Use concrete words. Key decision making depends on your report; so you can leave your findings open to interpretation.

- Keep sentences short. Short sentences drive readability and comprehension.

- Vary sentence structure and types. Use a variety of sentence structures; simple, complex and compound. Don’t limit your report to one type of sentence. Use interrogative, assertive and exclamatory sentences as well. Your readers will then find your report more interesting.

- Maintain unity. Do not discuss multiple ideas in the same paragraph. If you do, your report will leave your readers exasperated.

- Use diagrams and stat data wherever possible. This practice adds authority to your report. This way, your report reliability is heightened.

- Add interpretations with every diagram. Don’t make the readers work for them. Do not make your readers perform a mental calculation.

- Connect your findings with the research objectives. This reduces time on the marketing end and helps them to comprehend the report.

- Maintain a uniform level of accuracy among all your data. If you present data within two decimal places accuracy, then maintain it throughout your report.

- The longer your report, the better. This does not mean that you should include information that the marketing department isn’t interested in. The information must be relevant to your audience.

How do I ensure all my market research activities are ethical?

We want to refer to Dr Alan Wilson, professor of marketing at the University of Strathclyde, regarding marketing research ethics.

According to the prominent researcher, whoever is undertaking marketing research must:

- Conduct market research in a way that promotes goodwill on the respondent’s end. Make sure that the importance of your research is clear to the respondents. This encourages them to be more forthcoming.

- Maintain professionalism. Make your research as professional as possible. If your participants sense a lapse in professional integrity, they will feel undervalued.

- Ensure the confidentiality of participants’ data. Make sure the data your market research participants want to keep private stays private. This practice will motivate them to engage better in future research endeavours.

- Honour the trust of the marketing department. The marketing department does not have the time to crosscheck your data. They will assume that you have conducted thorough research. Make sure you do not give them a reason to doubt your findings.

The method of market research we have discussed in this guide is a scientific method. This method can be used for any scientific research purpose.

The scientific research method consists of the following steps:

- Formulate a problem.

- Develop a hypothesis

- Make predictions based on the hypothesis

- Devise a test of the hypothesis

- Conduct the test

- Analyse the results

- Present the findings in a comprehensible manner for the target audience

Do not let the market research process intimidate you.

Since there are so many steps in the process, you might feel overwhelmed, especially if you are managing both the marketing and the research.

Let us assure you that it is alright to feel that way; we suggest you take it one step at a time. If possible, initiate research on a smaller scale to get the hang of it. Once you do, you’ll find insights you never anticipated.

Just remember. The more effective research you perform, the further you get ahead in the industry. That is the reward of informed decision-making.

Our last piece of advice? Embrace this process! It will be well worth your time and effort!

You read a lot. We like that

Want to take your online business to the next level? Get the tips and insights that matter.