Chargebacks: How You Can Protect Your Business from It

Chargebacks. They can feel like a strangling noose around the profit margins of merchants both online and brick-and-mortar!

This feeling was justified by a study which shows that merchants lose almost $300 from every CP transaction made via credit cards from some of the major card issuers like AMEX and Discover, and it’s not just your hard-earned revenue that takes a slam!

Credit card issuing companies like VISA, AMEX and Discover impose an industry-wide 1% chargeback limit. In layman’s terms, this means that for every 100 transactions that you process at your store, a maximum of one is allowed to face chargeback issues.

So what happens if you stray outside the green zone of 1%? You will be given an interval time (a corporate euphemism for warning) during which you will need to bring your chargeback-to-transaction ratio under 1%. If you keep moving into the red zone, your bank will suspend and most possibly terminate your merchant account.

And the bank or financial institution won’t stop there. They would put you in the ‘Match List.’ This is NOT a list you want your business to be on; in the case you do end up on it, it’s likely no other institution will let you host your merchant account with them. And even if they do, you will be charged higher processing fees.

So what is the silver lining? How can you continue to provide your goods and services to customers without being afraid of a financial reckoning?

Keep reading and find out.

What exactly is chargeback?

A chargeback is a sort of refund. It is the amount transferred from the merchant’s (yours in this case) bank account to the cardholder’s (your customer) bank account because of a verified claim.

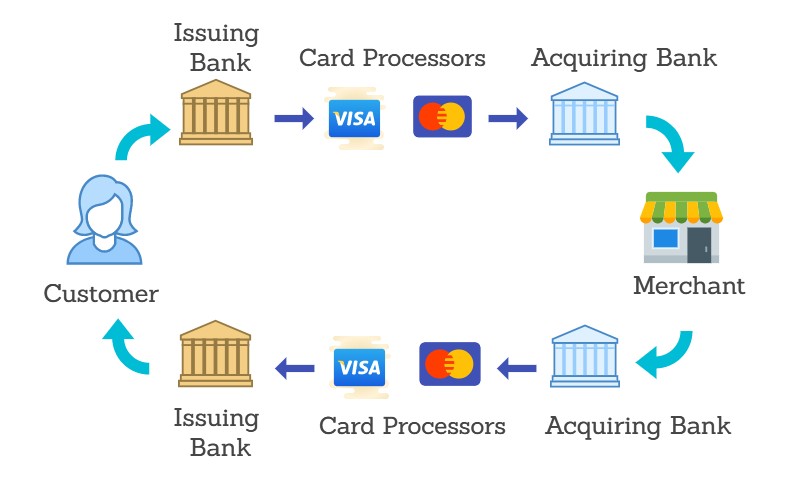

Breaking down the chargeback process

Let us break down the chargeback process for you before we talk about how you can weather it.

Step 1: Cardholder initiates a transaction dispute

This happens when a cardholder, (your customer) does not recognise a transaction on his/her statement.

Step 2: The card issuing bank advises your bank after determining the reason behind the chargeback

The reason could one of the following:

- The requested item was not delivered

- The transaction has been processed twice

- The product does not match the description on your business website

- The customer’s card is expired

- The transaction value crossed the cut-off limit

- Cardholder identity was not verified

Step 3: Your bank sends you a notice requesting that you provide evidence regarding the transaction. It is mandatory that you, the merchant, provide the requested evidence within the stated duration; this duration is usually ten days.

If you fail to comply, the chargeback amount will be debited to your account, i.e. you lose money!

Now let’s discuss how you can fight back against chargebacks!

Here comes your battle strategy; pay attention!

Since chargebacks are a complex issue, we have formed a multi-faceted strategy. Any simpler and it may not be enough to help you fight this issue effectively at all stages. There are three aspects to the strategy.

1. The psychological preparation

Psychological preparation happens to be the first and foremost step to take in this battle.

With the right frame of mind, you will be more realistic in your approach to chargebacks. As a result, you’ll spare yourself any stress that might result from the implementation of your strategy.

The fact you need to accept

Since chargeback claims are increasing over time, this is not something that is going to go away. In fact, it is going to rise every year according to Invesp.

For this reason, you need to accept the fact that you will never be able to stop chargebacks from happening permanently.

This acceptance shouldn’t give you the impression that you are going to live peacefully with chargebacks, however. Accepting a problem as a problem keeps you in touch with reality and you can look for effective solutions.

Now, let’s proceed to the second step in the chargeback strategy.

2. Take chargebacks with the utmost seriousness!

If you are facing a chargeback for a transaction of $100 value, it will cost you an average of $240!

The reason a chargeback claim can cost you more than the value of the transaction is because of various processing fees imposed on you by financial institutions and the fact that you are not going to get your merchandise/service back.

At this point, you should have a very clear idea about how detrimental chargebacks can be for your business. You should also have the mindset to fight them effectively!

Let’s move forward to the third step.

3. Preventive measures

Preventive measures are deterrent forces. If you want to prevent chargebacks from being claimed in the first place, these are measures you need to have in place yesterday!

These measures are:

Use an easily recognisable transaction descriptor

The way your business appears in the transaction description of your customer’s card statement is crucial. If they do not match, your customer will be confused and might suspect foul play. This inference – even if it is wrong – may lead the customer to file for a chargeback.

One mistake companies make is that they register with a payment processor company using the parent company’s name instead of their name. Here’s an example.

Suppose the Escala Fitness clothing brand-is owned by Alphabet Inc. Then a customer, Josie, orders two pairs of leggings from Escala at a price of $137.78. The delivery is delayed due to a storm which Escala informs Josie of in advance. Later, on her card statement, Josie sees the name “Alphabet Inc” instead of “Escala,” which she is expecting. She immediately contacts her bank to initiate a chargeback.

Avoid this mistake at all costs!

If you want to find out how your company name appears in your customers’ statement, contact your payment processor or merchant account, provider.

Pick a payment processor that comes with anti-fraud features

It is integral that the payment processor that you implement in your business site has in-built fraud prevention mechanisms. This is of paramount importance as 6 out of every ten chargebacks are fraudulent transactions.

Payment processors like Authorize.net and eWay boast some highly competent fraud prevention features like transaction filters, IP filters, and real-time screening, among many others.

Cutting down merchandise delivery times

If you are selling physical products and it takes weeks for your product to reach the hands of your customers, then the chances of them forgetting your brand name spikes. That spike will, in turn, hike up the chance of a chargeback being claimed.

The occurrence of such cases is supported by a study conducted by Midigator which shows that over half of all chargebacks are filed within 30 days of the transaction taking place.

According to the answers posted to the question “How often do people check their bank balances?”, most people have stated that they check theirs daily while some do it every week.

This is confirmed by Ladders as well! 4 out of every 10 Americans check their bank balance almost daily with another 4 doing it once a week.

What does this mean for your business? Well, the sooner your product reaches your customer’s waiting for hands, the lower the chance of them claiming a chargeback!

Being there for your customer up to, and beyond, the moment your product reaches them

Many questions cross your customer’s mind about your product or service, even after making payment. If you address any queries as soon as possible, your customer is reassured about your brand’s reliability. Being put in such a positive light drastically reduces the chance of a chargeback happening.

So if a customer reaches out to you via live chat or a social media message, do respond as soon as possible!

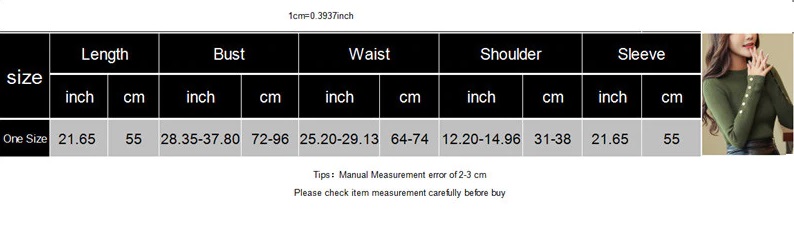

Clearly explain any issues about your product that may lead to unease for your customer

There are several issues about a product that may raise your customer’s eyebrow. These issues include colour, measurements, ease of use and so on.

If you clarify these issues on your website’s product page, your customer would be mentally prepared. As a consequence, the chance that they will file a chargeback is almost zero.

AliExpress is known for this practice.

In their clothing product descriptions, they mention that because of manual measurement, there may be discrepancies. Or that the product colour, in reality, may be slightly different from what is shown on the website, due to screen resolution.

Including these details is a great practice when you are selling physical products! This way, your customers are informed about any issues regarding your product up front. Having such knowledge puts your customers at ease, and you appear truthful and customer-oriented! Who doesn’t love that?

Charging your customers after providing a service, or after your product reaches them

When a customer sees that they will be charged AFTER receiving your service or your product, they are inclined to trust you immediately, or at least will not be anxious that you might not hold up your end of the deal; or worse, scam them.

The relief that comes from this realisation will reduce the chances of any chargeback claims almost to zero!

Making your business more reliable by offering a money back

Offering a money-back guarantee creates the impression that you have full confidence in your service or product, and you are committed to fulfilling your promise.

Just like charging your customers after service delivery, this measure lets your potential customers worry less when buying from you.

Even though only about 1 out of every five cardholders contact the merchant directly for a refund, the odds will be better for you if you offer a refund and provide easy ways of contacting your business!

Make specific information on your business policies easy to find and understand

Business policies tend to be text-heavy documents. For a customer, finding a key piece of information such as refund conditions, shipping time, products that fall under special conditions and so on can be extremely difficult.

When a customer files a chargeback dispute, it is often the case that their issue was clearly addressed in the relevant policy document.

To prevent such chargeback claims from taking place, we recommend you to adopt the following practices when drafting your business policies:

- Break down the large paragraphs into smaller ones.

- Make key pieces of information bold and italicised.

- Place images or icons that help to locate information easier. For example. a dollar sign can indicate refund policies, an aeroplane can indicate to shipping duration and methods etc.

Now that all the defences against chargebacks are set up, it’s time to prepare for the worst.

You have been issued a chargeback notice; what to do next.

As we have mentioned before, the chargeback is a reality you will have to accept. Which means that, despite all the preventive measures discussed above, there is still a chance that you’ll be slammed with a chargeback notice from your bank!

This statement is based on a report by Chargebacks911 who found that over 7 out of 10 participants in one of their surveys are facing a chargeback.

We are telling you this because over 8 out of every ten cardholders simply find filing a chargeback convenient! So it is only practical to prepare for a chargeback dispute. It would pay to listen well. Literally!

Assess your chance of winning the dispute

When you carefully consider your options and assess the data at hand, it should be easy for you to figure out the next step. This data includes may include but is not limited to:

- Purchase receipts

- Communication between you and the customer (email, live chat etc.)

- Delivery confirmation reports

- The IP address of the downloading PC, download date and time (for digital content)

- Your business policies

Performing this assessment will help you take an educated approach to handle the dispute. And this educated approach will require you to consider:

- The value of the transaction in question

- The cost you would incur in a case where you lose the dispute

- The number of chargebacks you have already faced in the current and previous month

- The availability of all relevant documents mentioned above

If you have faced zero chargebacks in the current and previous month and you have all transaction details available, then we suggest you fight the chargeback claim.

According to Midigator, merchants have about an 80% chance of winning a chargeback dispute!

If there is a history of chargebacks in the current and previous month, then we suggest you try to resolve the issue by offering a refund to the customer.

Offering a refund has several benefits. Those are:

- It costs a lot less than losing a chargeback dispute

- It helps you keep your chargeback ratio under the red line

- It puts you in a positive light with the customer in question.

You need to keep in mind that we are NOT suggesting you offer a refund in every chargeback dispute case! If you believe you have a strong case, then do contest the claim by filing a counter-claim.

Address the chargeback claim notice ASAP

If you have paid attention to this article from the beginning, you already know how adversely chargebacks can affect you, so it would be pointless to delay your response to a chargeback notice from your bank.

A very good tip from Philip Parker to reduce the time needed to respond to a chargeback claim is to have a chargeback dispute response template ready.

With such a template at your disposal, all you need to do is fill in the necessary details regarding the notice and the transaction in question.

As a result, you will have more time to prepare for the fight by gathering documents. As the old saying goes, “preparation breeds confidence”.

Use a third-party chargeback processor

Chargebacks911, a reputable chargeback processing company, has observed that businesses which use a third-party solution instead of fighting a chargeback claim on their own have won a higher number of chargeback disputes.

Thus, we strongly advise that you rely on such a service. This will leave you with more time to focus on business growth.

According to our research, some of the best chargeback handling solutions are:

You can prevent chargebacks, and win them too!

As the saying goes, “prevention is better than cure”. The same holds true when it comes to chargebacks.

Preventing chargebacks will become a lot more important over time, as the number of fraudulent transactions is spiking at an unprecedented rate.

As discussed above, there will be situations when you have to fight chargeback claims. As per our research, most claims have been filed by the customer out of sheer convenience.

Before we conclude, we would put emphasis on formulating your own chargeback prevention and winning strategy. This will require paying close attention to all details of your chargeback cases. That way, it’s possible to assess your strategy and tailor it to your business.

Once again, do not fear chargebacks. Accept them. Keep the right mindset and implement all possible preventive measures. And when it comes to a fight, give it your everything. Good luck!

You read a lot. We like that

Want to take your online business to the next level? Get the tips and insights that matter.